Money Management – An introduction to the Kelly Criterion

An introduction to the Kelly Criterion.

A few weeks ago we had a guest post talking about proper bankroll management and last week I introduced the concept of Advantage Wagering and Expected Value.

Today I am going to introduce you to the Kelly Criterion, which combines the concept of bankroll management and advantage wagering to help you determine your optimal bet size.

The Kelly Criterion

There is a lot of information on the Internet about the Kelly Criterion, so I won’t go into too much detail here, other than to give you a brief overview of the concept.

Kelly is simply a money management formula that takes into account your bankroll size and the edge you have on each game and tells you how much to bet on each game to maximize bankroll growth.

The formula for calculating Kelly is as follows:

K(elly) = (P*O – 1) / (O – 1)

K = % of your Bankroll you will risk on each wager

P = your win % … the probability that you will win the bet

O = Odds …. This is the actual payout on the bet (using decimal odds a line of -110 would equal 1.91)

Example # 1. Let’s assume your bankroll is $5,000 and you believe Alabama -10 has a win probability of 55% at -110 odds. Based on the Kelly Criterion you would wager the following:

Kelly Stake = ( 55*1.91 – 1) / (1.91-1) = 5.50% of your bankroll, or $275

Example # 2. How about an extreme example? Alabama is -14 in Tuscaloosa vs Texas A & M, but your local bookie, who is obviously drunk and/or high on drugs at the time, offers you Alabama at a pick ‘em for even money (+100). Based on the Kelly Criterion, how much should you wager on Alabama in this game?

You quickly determine that Alabama has about an 85% chance of winning this game (a 14 point favorite typically would have a ML around -825, which would convert to a ~85% win rate). Based on Kelly you would wager the following:

(85*2.00 – 1) / (2.00 – 1) = 70% of your bankroll, or $3,500

Johnny Football and the Aggies SHOCK Alabama 29-24. OOOOHHHHH! The Horror.

The problems with the Kelly Criterion

OK, the above extreme example may have been a little too extreme, and I doubt anyone is going to wager 70% of their bankroll on a single game, no matter how attractive the odds.

My point is that no matter how good the Kelly Criterion looks in theory, in reality there are some faults with this money management strategy.

Determining your edge

The first problem I have with Kelly is that it is IMPOSSIBLE to determine your actual edge on a college football game (or on any sporting event for that matter). The best you can do is make a calculated guess.

Some people are obviously better than others when it comes to determining their edge. But if you are using Kelly and your win probability estimate is flawed then so to will be your edge estimate. And a depleted bankroll will soon follow.

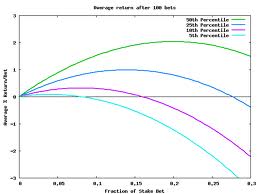

Losing streaks

As our first example showed, if you believe Alabama has a 55% probability of winning at -110 odds, Kelly recommends wagering 5.5% of your bankroll. But what if you think Alabama has a 60% probability of winning at -110 odds?

Kelly Stake = ( 60*1.91 – 1) / (1.91-1) = 16.04% of your bankroll, or $802.20

A 5% increase in Alabama’s probability of winning results in your wager more than tripling.

For conversation purposes let’s assume your estimated edge is accurate. You’re still wagering an extremely large chunk of your bankroll on a game/event that involves a lot more luck (variance) than we would like to think.

Remember, as I pointed out in my article on Expected Value, a +EV wager means that if you were to make the same bet over and over again, in the long run you can expect to win more times than you lose.

But that doesn’t mean that if the game were played 10 times, you would win 6 and lose 4. It more than likely means that if the game were played 1000 times you’d win 600 and lose 400. And how those 400 losses are distributed is the problem. Six or seven losses in a row and your bankroll is more or less depleted.

The Kelly Criterion in summary

I’ll be the first to admit that I am by no means an expert on the Kelly Criterion, my math skills are average at best and I only briefly touched upon the theory in this article.

I’ll be the first to admit that I am by no means an expert on the Kelly Criterion, my math skills are average at best and I only briefly touched upon the theory in this article.

There are additional parts that I didn’t even mention like simultaneous wagers and all the Kelly variations that people use (1/4 Kelly, ½ Kelly, etc).

The main lesson I take away from the Kelly Criterion is the concept of wagering different amounts on different games.

If you estimate that you have a +5% edge on one wager and +10% on another wager, than it only makes sense that you should try and maximize your profit by betting more on games that have higher perceived +EV. However, since it is impossible to know your exact edge on a sporting event, if you put too many units on a bet, or a few bets, you’re essentially putting your bankroll in the hands of variance.

My personal preference is to keep my bet size more condensed. I like betting between 1% or 2% of my bankroll instead of 1%, 5% or even 10%.

For example, if I believe I have a +EV wager I will bet 1%. If I believe I have a wager that is better than my standard 1% (or 1 unit) wager than I may wager 1.25% or 1.5%, and if I believe I have an absolute Best Bet type wager I will bet 2% (or 2 units). I think it is ridiculous when someone wagers 1 unit on one game and 5 or 10 units on another game.

Just keep in mind that no matter how good you think a wager is, your perceived edge is still a calculated “guess” and the outcome is still influenced by variance.

When it comes to bankroll management, there are no exact rules, just best practices, and everyone has to find their own comfort zone.

Please feel free to add any additional information, thoughts or ideas on the Kelly Criterion in the comments section below. If you have any specific college football handicapping questions you would like to ask us or have any handicapping theories you would like to share, please feel free to email me at pezgordo@saturdayedge.com or send us a question on Twitter @saturdayedge.

Tags Bankroll ManagementBetting strategiesbetting tipsExpected ValueKelly Criterionmoney management

One thought on “Money Management – An introduction to the Kelly Criterion”